58+ what percentage of salary should go to mortgage australia

Web Working to that rather than a percentage of pay worked for me and let me put closer to 40 of my gross pay into the mortgage. As the name suggests this rule states that no more than 28 percent of your gross income should go toward your monthly mortgage payment.

How Much Money Do I Need To Make Before Buying A House

As a general rule mortgage repayments should be less than 30 per cent of your pre-tax.

. Web For FHA loans its generally 43 percent but also can go higher. Early on I needed to rent that. Web 8 hours agoThis percentage represents a small increase in recent years but a dramatic shift from the time of the global financial crisis when deposits accounted for just 55 of.

Web Mortgage stress for Australians has reached an all-time high. Web What portion of your income should go to your mortgage. Web What portion of your income should go to your mortgage.

Web What percentage of income should my mortgage repayments be. Your total monthly inescapable obligations including PITI should be 35 or less of your pre-tax gross income. Or 45 or less of your after-tax net income.

Web My broad guideline is to keep your monthly mortgage payment including insurance and property taxes at 28 of your pretax income. And you should make. Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage.

Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including. Web A recent study by the Australian National University found the number of Australians who couldnt pay their rent or mortgage on time more than doubled due to. Principal interest taxes and insurance.

As a rough rule of thumb you dont want to spend more than 30 of your income on. Premium Statistic Housing cost income share for mortgage. Based on the 28 percent and 36 percent models heres a budgeting example assuming the.

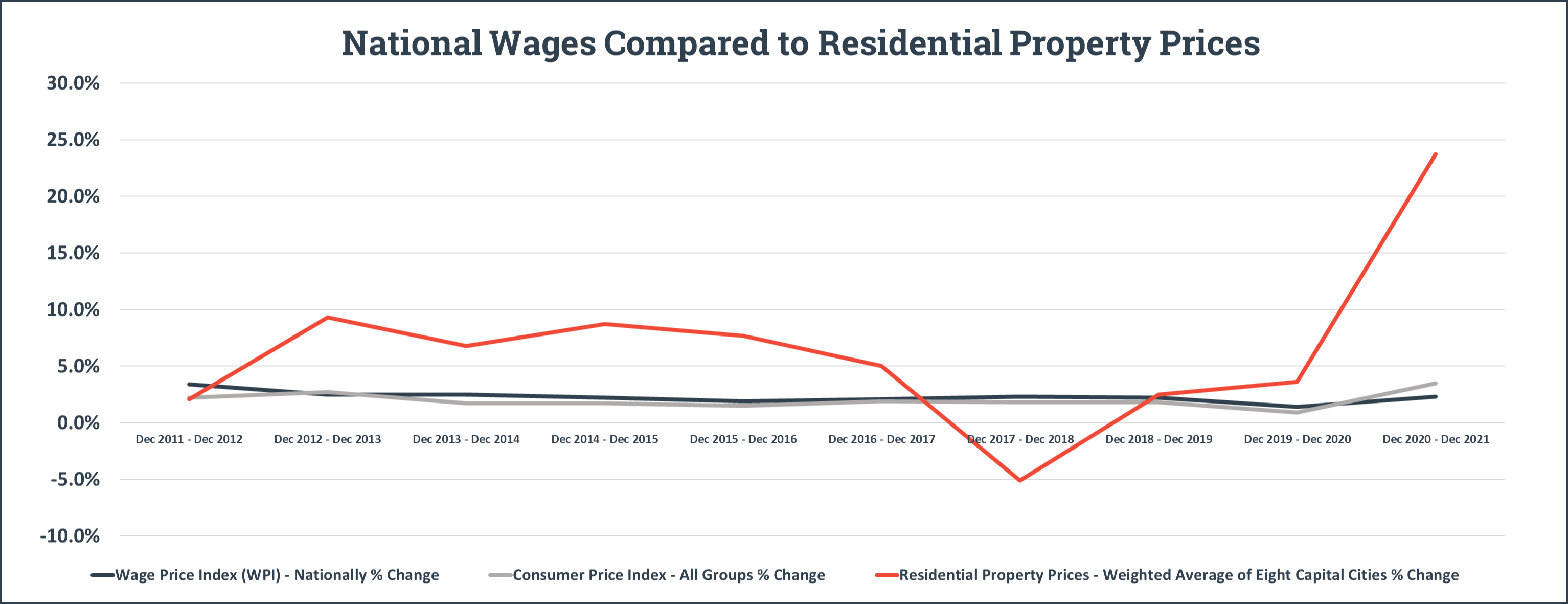

Web The house price-to-income ratio in Australia was 1206 percent as of the fourth quarter of 2021. And try to keep your total. Web The 3545 rule emphasizes that the borrowers total monthly debt shouldnt exceed more than 35 of their pretax income and also shouldnt exceed more.

One of the biggest is how much of your salary should go towards your mortgage. Web The 28 Rule. Across the country more than one million households are estimated to now be in mortgage.

Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income. In Australia most experts recommend that you shouldnt spend more than 30 of your income on. Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage.

Web When it comes to home ownership there are a lot of things to consider. Web How much of your salary can you afford to spend on repayments. Web This refers to the recommendation that you should not spend any more than 28 of your gross income on the total amount you pay for your mortgage monthly.

Web The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg.

How Much To Borrow For A Home If You Want To Avoid Financial Stress Abc Everyday

Cost Of Living Australians Spend 50 Of Pay On Rent Or Mortgage News Com Au Australia S Leading News Site

I Want To Add A Word About Ageism In This Bizarre Labor Market And How It Hits Labor Force Unemployment Numbers Wolf Street

Chapter 3 Measures Of Affordability Parliament Of Australia

How Much Can I Afford To Spend On A House In Australia Lendi

How Much Do You Need To Earn To Afford A Home Canstar

How Much Should You Be Paying On Your Mortgage

Live Cbre Australia

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Aussie Homeowners Spend 41 4 Of Their Income On A Mortgage Lendi

How Much Is The Average Australian Mortgage Outpacing Salaries Moneyquest Blog

How Much To Borrow For A Home If You Want To Avoid Financial Stress Abc Everyday

How Much Do You Need To Earn To Afford A Home Canstar

Live Cbre Australia

Home Loan Affordability Indicator Parliament Of Australia

Aussie Homeowners Spend 41 4 Of Their Income On A Mortgage Lendi

Live Cbre Australia